Crypto mining isn’t your quick path to riches. You’ll need specialized hardware costing thousands, technical knowledge, and cheap electricity just to compete. Mining rewards have halved to 3.125 BTC per block, while electricity consumption rivals small countries. Solo mining? Good luck waiting for that payout. Pools offer consistency but smaller rewards. Environmental impact? Massive. Security risks? Plenty. You might earn $300-$500 monthly after expenses—if everything goes perfectly. The alternatives might surprise you.

What Is Crypto Mining and How Does It Work?

While many people think crypto appears out of thin air, it’s actually created through a process called crypto mining.

It’s fundamentally bookkeeping for digital currencies—but with computers sweating instead of accountants.

Here’s the deal: miners validate transactions and add them to the blockchain structure.

They compete to solve complex mathematical puzzles using hash functions—basically, playing a high-stakes guessing game with expensive computers.

First one to crack it? They get to add a new block and score some fresh coins plus transaction fees. Sweet deal.

The whole system runs on Proof of Work.

Most miners now join mining pools to increase their chances of earning steady rewards.

No central authority. Just a bunch of computers reaching consensus on what’s legit.

That’s what keeps these digital currencies secure and decentralized.

Weird but genius, honestly.

This mining process creates new bitcoins approximately every 10 minutes, maintaining the circulation and integrity of the cryptocurrency.

The environmental impact is significant, with Bitcoin mining alone consuming more electricity than some entire countries.

Essential Hardware and Software Requirements

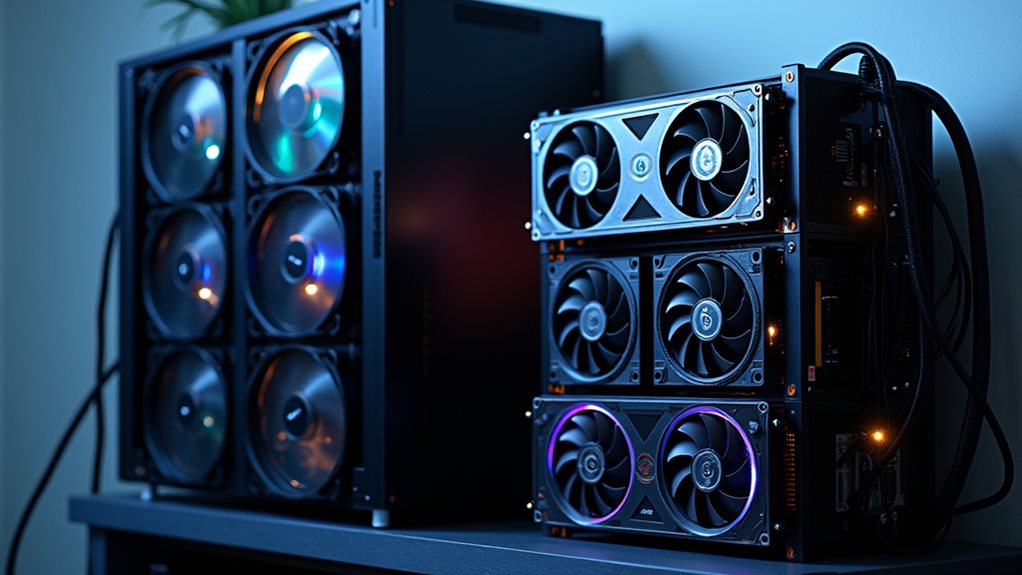

So you’ve learned what mining is—now let’s talk gear. Your hardware selection will make or break your mining operation. ASICs deliver insane hash rates for Bitcoin but cost a fortune. GPUs offer more flexibility for altcoins. Don’t even think about CPUs—they’re mining dinosaurs now.

Hardware is everything in mining—ASICs crush Bitcoin but break the bank, while GPUs handle altcoins with flexibility. CPUs? Don’t waste your time.

Your mining setup needs:

- A proper mining rig (ASIC or multiple GPUs) with adequate cooling

- Reliable PSU with 20% extra capacity—skimp here and watch your investment literally go up in flames

- Stable internet connection—because mining disconnects equal lost profits

- Compatible mining software for your hardware/coin combo

Software compatibility matters. Whether you choose CGMiner, BFGMiner, or specialized options like Hive OS, you’ll need software that plays nice with your hardware. Block rewards continue to decrease through halving events, making efficiency crucial for long-term profitability.

Regular firmware updates are non-negotiable for peak performance. For serious Bitcoin miners, purpose-built ASICs provide superior energy efficiency and profitability compared to general-purpose computing hardware. Top-tier miners should research models like the AntMiner S19 Pro and Whatsminer M30S++ for their high hashrate capacity.

The Economics of Mining: Costs vs. Rewards

Before you dive headfirst into the mining gold rush, let’s crunch some cold, hard numbers. Mining rewards currently sit at 3.125 BTC per block—half what they were before April 2024. Yeah, that’s reality. With block halving events continuing until 2140, rewards will keep decreasing.

Equipment? Not cheap. Expect $2,000 to $20,000 per machine. Modern rigs cost about $16 per terahash—way better than 2022’s $80/TH price tag. But still.

Your profit margins hinge on electricity costs. Location matters significantly. Norway? Great. Manhattan? Forget it. Some miners are exploring the use of flare gas from oil wells as a cost-effective energy alternative. The most successful operations typically secure renewable energy sources to maintain sustainable profits despite rising network difficulty.

High-performance setups might net $300-$500 monthly after powering those hungry machines. The network keeps getting more competitive, making operational efficiency utterly essential.

Bottom line: The Bitcoin network generates about $20 million daily. Your slice of that pie? Shrinking by the minute as difficulty climbs and rewards halve.

Mining Pools vs. Solo Mining: Which Path to Choose?

After considering the economics, you’ll need to decide: mine alone or join the crowd?

Solo mining offers complete independence—no fees, total control, maximum rewards per block. But let’s be real. Unless you’ve got serious hardware, you might wait forever for a payout. Hardware wallets are essential for securing your mining rewards regardless of your approach.

Going solo means keeping every satoshi but might leave you waiting until the heat death of the universe for a reward.

Pool strategies offer predictability. You’ll sacrifice a small percentage (up to 4%) but gain regular income. No more revitalizing your wallet hoping for a miracle. Solo miners who find a block keep the full 3.125 BTC plus transaction fees. Mining pools require less computational resources, making them more accessible for individual miners.

- Solo benefits include complete privacy and autonomy—nobody seeing your data

- Pools provide steady, smaller payments instead of rare jackpots

- Technical support comes with pools, making setup easier

- Your hashrate determines which makes sense—tiny miners need pools, period

Pools win for beginners. Solo mining? That’s for the big players or the stupidly stubborn.

Environmental Impact and Energy Considerations

While you’re plotting your mining strategy, there’s an elephant in the server room. Bitcoin mining devours electricity like a hungry teenager after football practice.

We’re talking 138 TWh globally—comparable to entire countries like Mexico or Italy. Yikes.

The environmental sustainability score? Abysmal. About 85% of US mining electricity comes from fossil fuels, pumping out 86 megatons of CO2 equivalent. If bitcoin mining were considered a country, it would rank 27th globally in energy consumption.

That’s 8.5 billion pounds of coal, fundamentally.

Energy efficiency? Not Bitcoin’s strong suit. Your mining operation will guzzle water too—globally, mining uses more water than 300 million people in Sub-Saharan Africa.

Plus, you’ll be contributing to air pollution that affects nearly 2 million Americans. Those particles travel hundreds of miles from mining sites.

The mining landscape has shifted dramatically as China’s share dropped from 73% to 21% due to government interventions, redistributing the environmental burden to other countries.

Convenient how this rarely makes it into those get-rich-quick mining tutorials, right?

Security Risks and How to Mitigate Them

Despite what crypto evangelists claim, your mining operation isn’t just a money printer—it’s a glowing target for cybercriminals.

Crypto miners beware: your digital gold rush is a beacon for hackers waiting to empty your wallet.

Security threats come from all angles: phishing emails, malicious websites, and even fake mining pools designed to steal your hard-earned coins. Surprise!

The worst part? While you’re getting hacked, your hardware might be cooking itself to death. Cryptojacking malware pushes systems to their limits. The global impact is massive with browser-based miners accounting for 35% of online threats following Bitcoin’s price surge. Managing multiple wallet types can provide additional security through asset diversification.

Protect yourself with these mitigation strategies:

- Use offline cold wallets instead of hot ones connected to the internet

- Enable two-factor authentication (2FA) on everything

- Deploy web application firewalls to block unauthorized access

- Segregate your mining network from your personal one

- Implement real-time monitoring tools to catch threats before they cause financial damage

Don’t be the sucker who loses everything because “security seemed complicated.” It is. Deal with it.

Alternatives to Traditional Mining Worth Exploring

Now that you’re fortified against security threats, let’s look beyond the standard mining playbook. Not everyone needs to drop thousands on ASIC rigs that become doorstops when algorithms change.

ASIC resistance is a growing trend, with coins like Ravencoin and Vertcoin deliberately keeping big players at bay. With quantum computing threats looming, ASIC-resistant coins may offer better future-proofing. Monero’s RandomX algorithm makes it particularly resistant to specialized mining hardware, maintaining better decentralization.

GPU alternatives strike a sweet spot—decent profitability without requiring a second mortgage. Coins like Ergo and Zcash welcome your graphics card with open arms. Zcash’s Equihash algorithm is intentionally memory-intensive to maintain fairness for individual miners.

CPU mining still exists (barely). It’s perfect for dabblers and the perpetually curious. Monero doesn’t laugh at your laptop.

Cloud mining? Someone else handles the hardware headaches while you pay for the privilege.

Merged mining lets you dig up multiple coins simultaneously—like getting Dogecoin while mining Litecoin. Same work, double prizes.

Frequently Asked Questions

How Does Cryptocurrency Taxation Work for Mining Income?

You’ll pay ordinary income tax on mining rewards at their fair market value when received. You’re facing tax implications whether you sell or hold, with reporting requirements on various IRS schedules depending on your mining classification.

Can Mining Damage My Computer Hardware Over Time?

Yes, mining will damage your hardware over time. It creates excessive heat that reduces hardware lifespan and accelerates wear. You’ll need robust cooling solutions to minimize damage, but components will still deteriorate faster than with normal use.

Are There Quiet Mining Setups Suitable for Residential Areas?

Yes, there are quiet mining options. You’ll find silent miners like the Avalon Q (45 dB) perfect for home setups. Consider immersion cooling or hydro cooling systems to drastically reduce noise in residential areas.

How Do Network Upgrades Affect Existing Mining Operations?

Network upgrades can drastically impact your mining operation by altering difficulty levels, requiring hardware updates, and affecting network stability. These changes often directly influence your mining profitability, sometimes forcing operational adjustments or new equipment investments.

What Skills Should I Develop Before Starting a Mining Operation?

You’ll need technical skills for hardware optimization and energy efficiency management. Develop knowledge in blockchain technology, programming, and analytics. Learn about cooling systems, component repair, and cryptocurrency fundamentals to run profitable mining operations.