The U.S. government just moved $219,000 worth of Ethereum from a dormant FBI wallet to Coinbase Prime, and crypto traders are sweating. The 86.56 ETH transfer came from funds seized from NFT scammer Chase Senecal back in 2022. Federal agents are sitting on roughly 100,000 ETH—worth over $650 million. Coinbase Prime typically means liquidation is coming. The Biden administration has been aggressively selling seized Bitcoin lately. This could be the start of something bigger.

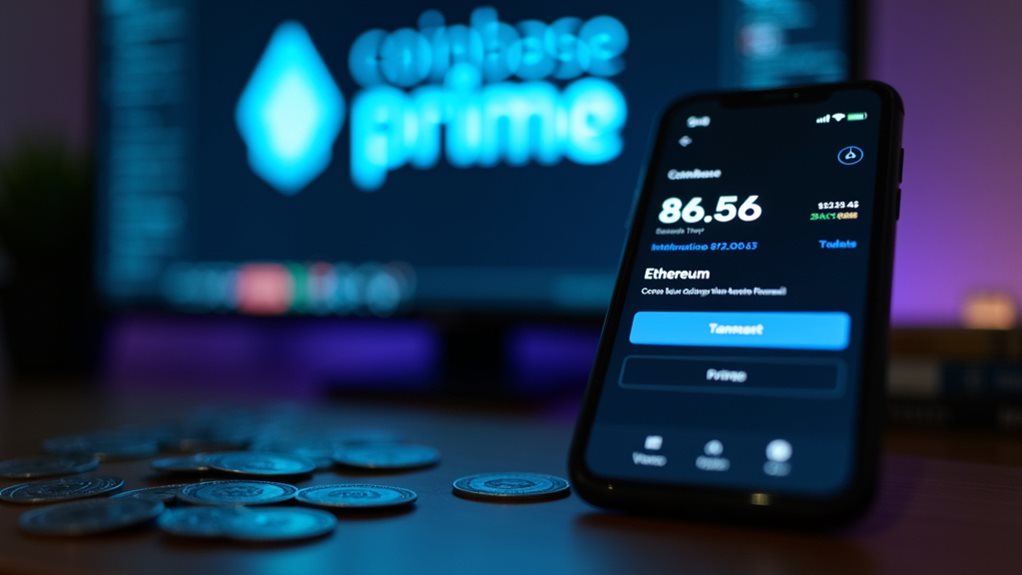

The U.S. government just moved $219,000 worth of Ethereum to Coinbase Prime, and crypto markets are paying attention. On July 7, 2025, federal agents transferred 86.56 ETH from an FBI wallet that had been sitting dormant since October 2022.

The wallet? Packed with over 100,000 ETH seized from NFT scammer Chase Senecal. Classic government move here—they sent a $10 test transfer first. Because apparently even the FBI doesn’t want to fat-finger a six-figure crypto transaction. Smart.

This particular stash represents just a fraction of Uncle Sam’s digital war chest. The feds are sitting on roughly 100,000 ETH total, worth over $650 million. Some reports peg it closer to 60,000 ETH, but wallet tracking isn’t perfect. Either way, it’s a lot of money.

The timing raises eyebrows. Ethereum was trading around $2,534 when the transfer hit, hovering near that vital $2,500 support level. The $200k move is pocket change compared to their total holdings, but it could signal bigger moves ahead. Rising concerns about market volatility have investors closely monitoring government crypto movements.

Here’s the thing about Coinbase Prime—it’s not your average retail platform. This is where institutions play. When government crypto ends up there, it usually means one thing: liquidation time. The Biden administration has been pretty aggressive about selling seized Bitcoin, so why would Ethereum be different?

Market watchers are split on what this means. Some think it’s prep work for a major selloff. Others speculate it’s just accounting housekeeping or custody restructuring. The government’s track record suggests the former—they’ve never been ones to hodl for the long term. The timing coincides with the U.S. establishing a strategic reserve for cryptocurrencies. The seizure was specifically aimed at recovering funds from Senecal’s fraudulent NFT activities.

The wallet had been completely inactive since the seizure. Now it’s moving. That’s not a coincidence.

Whether this leads to immediate market pressure remains unclear. But when a government wallet that’s been dead for years suddenly wakes up and starts moving assets to an institutional exchange, traders take notice.

The pattern is familiar: test transaction, followed by larger moves, often ending in public auctions or OTC sales. The crypto market doesn’t love uncertainty. And dormant government wallets coming back to life? That’s uncertainty with a capital U.