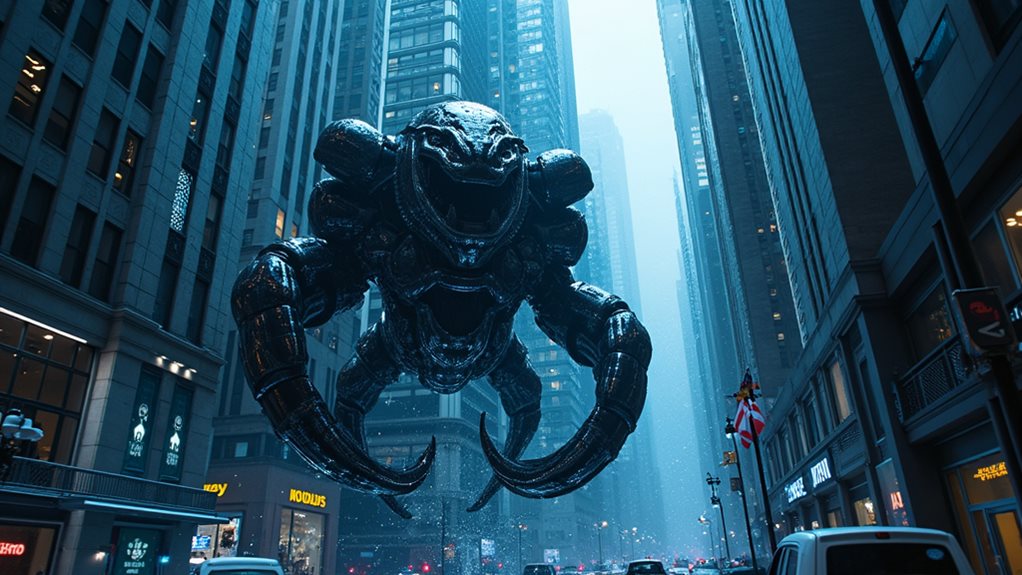

Kraken just slammed into Wall Street with a bold move—commission-free trading for over 11,000 US-listed stocks and ETFs. Talk about a gut punch to the big brokers! They’re starting in 10 US spots like New Jersey, aiming to go nationwide, even hitting the UK and beyond. It’s all on one app—stocks, crypto, cash, no hopping around. Targeting young, tech-savvy investors, Kraken’s playing hardball. Stick around, there’s more to unpack.

A seismic shift is hitting Wall Street, and Kraken’s the one swinging the hammer. This crypto giant just launched commission-free trading for over 11,000 US-listed stocks and ETFs, and yeah, it’s a big deal. Starting in 10 US jurisdictions—think New Jersey, Connecticut, Wyoming, and a handful of others—Kraken’s got plans to roll this out nationwide, then go global with the UK, Europe, and Australia on the horizon. They’re not messing around.

Stocks, ETFs, crypto, cash, stablecoins—all on one platform. One account. No juggling apps. It’s a slap in the face to the old-school brokerage model. Their initiative, led by Kraken Securities, ensures FINRA-regulated compliance for investor protection.

One platform for stocks, ETFs, crypto, and more. No app-hopping. Kraken’s smashing the outdated brokerage mold with ruthless efficiency.

Look, Kraken’s making it dead simple. Manage everything—stocks to crypto—in a single spot via their mobile app or Pro web interface. Sold a stock? Reinvest in Bitcoin instantly. Got crypto gains? Flip it to ETFs. Seamless. No waiting, no hassle. They’re even tossing in fractional share trading for over half their listed assets. Accessibility? Check. This move positions Kraken as a versatile trading platform catering to diverse investor needs. The timing couldn’t be better as spot ETF trading gains momentum among traditional investors.

And with a slick, tech-native vibe, they’re clearly gunning for the younger crowd who’d rather die than use a clunky broker app. Oh, and whisperings of 24/7 trading using crypto infrastructure? That’s a middle finger to Wall Street’s 9-to-5 snooze fest.

Kraken’s not just playing; they’re here to dominate. Calling themselves an “all-in-one trading powerhouse,” they’re challenging Robinhood and old dinosaurs like Schwab and Fidelity head-on. Commission-free? That’s a gut punch to traditional brokers.

And with crypto platforms like Bitpanda joining the trend, the line between TradFi and crypto is blurring fast. Kraken sees crypto as the future backbone for all trading—equities, commodities, you name it. They’re pushing a “borderless, always on” ecosystem, tearing down investing barriers with a smirk.

Backed by Kraken Securities LLC, a FINRA-regulated outfit, and a partnership with Alpaca, they’ve got the legal muscle. Sure, regulatory scrutiny looms—past SEC settlements sting—but with $1.5 billion in 2024 revenue and over 10 million users, Kraken’s laughing.

They’re not just disrupting; they’re rewriting the game. Wall Street, better watch out. Kraken’s hammer ain’t stopping.